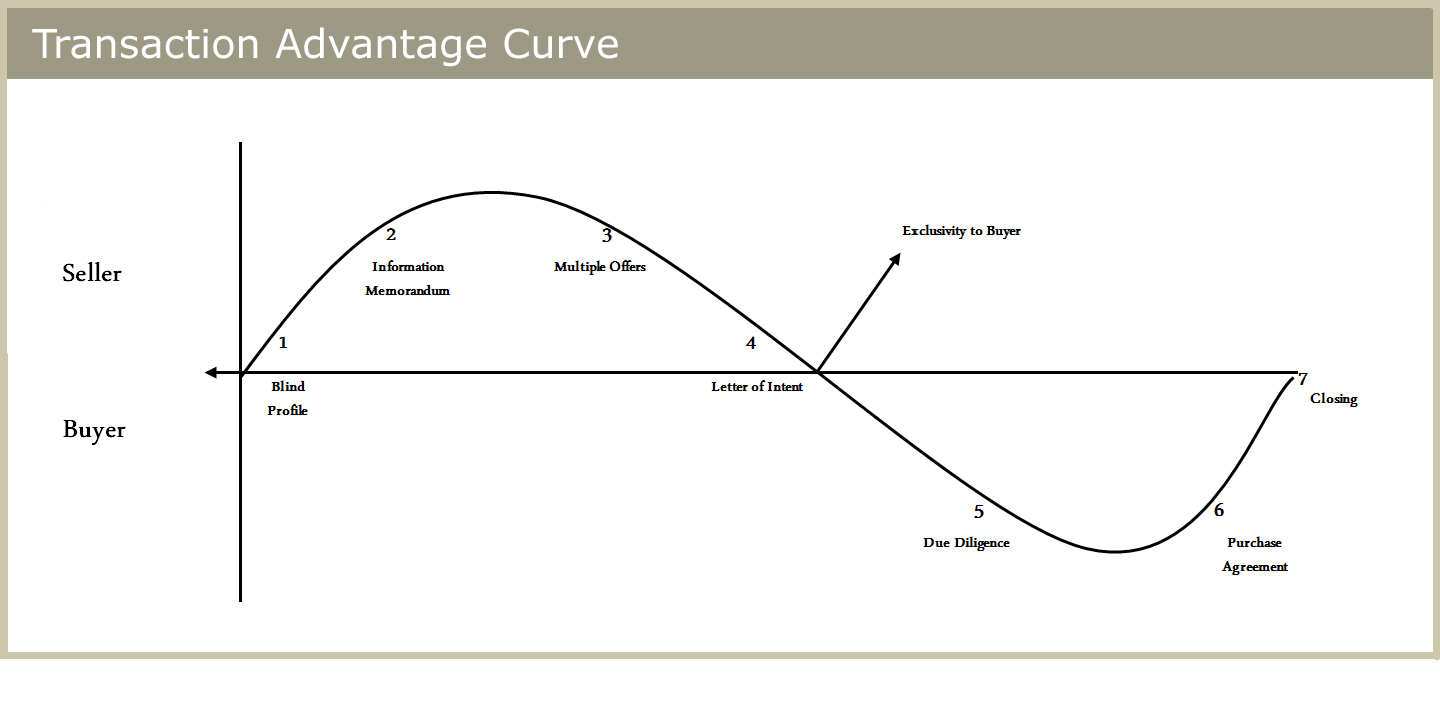

If you own a good company it is likely that you have been, at some point, contacted by someone expressing interest in acquiring your business. While it is flattering to receive these phone calls and even tempting to pursue discussions, we would urge you to take a step back. Look at the graph and consider that you might be playing directly into the strategy of the buyer. They know by contacting you directly they can avoid the “drive-up” in value associated with a competitive marketing process for your business.

If you own a good company it is likely that you have been, at some point, contacted by someone expressing interest in acquiring your business. While it is flattering to receive these phone calls and even tempting to pursue discussions, we would urge you to take a step back. Look at the graph and consider that you might be playing directly into the strategy of the buyer. They know by contacting you directly they can avoid the “drive-up” in value associated with a competitive marketing process for your business.

You may think the buyer that has called you is the best buyer for your business, but we can assure you that if there is one buyer, then there are others as well. You may even end up selling to the initial buyer; however, he will certainly be paying more if he has been put through the competitive bidding process.

Each step in the marketing process is designed to build more interest with potential buyers. Properly managed, this process has proven to yield better results than dealing with just one buyer.

Through the strictly controlled timing and release of information, the auction approach begins with an announcement of the business for sale (done through a blind profile, which simply means that all details that could identify the actual company are masked or left out of the announcement.) As buyers show interest and pass qualification (including signing confidentiality agreements), they are given a more detailed memorandum – much like a business plan.

After review of these materials and possible site visits, the process must be closely managed to obtain as many offers as possible during a short time frame. It will not support the best valuation to get one offer now and another one six months from now. All possible buyers must be encouraged to submit an offer during this controlled timeframe. It is at this point that the seller has the most advantage and can command the highest valuation.

As you can see on the curve, once a letter of intent is signed and a particular buyer is given an exclusive period of time for due diligence, the advantage begins to shift to the buyer. If you bypass the earlier marketing steps and jump right in with one buyer at this point, you have eliminated most of the seller advantage.

So, the next time your phone rings with someone wanting to buy your business, step back and decide if you want to give the advantage immediately to that buyer or take some time and maximize your advantage.

(Click on chart below to maximize.)

Posted by Michael Weiss.