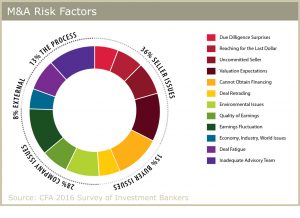

What keeps M&A transactions from closing? A recent survey of investment bankers at CFA regarding their experience with M&A deal failures leads to interesting results, as can be seen in the accompanying graphic.

Failure reasons can be broken into five general categories: Seller Issues, Buyer Issues, Company Issues, External Factors, and The Process. Not surprising, Seller Issues and Company Issues account for nearly 66% of deal failures. Buyer Issues and The Process account for 28% of deal failures.

What is the number one reason for deal failures? Earnings fluctuations, which means the earnings are not as projected. This causes significant problems for buyers, making valuations and lending much more difficult. Not surprising, the number two reason is Seller valuation issues, which means Sellers want more than their company is worth. Taken in the aggregate, across all five categories, valuation-related issues account for more than 52% of deal failures. Clearly, valuation/earnings issues are the number one cause of deal failures.

Surprisingly, external factors and the process itself do not cause as many deal failures. The silver lining in these results? Seller Issues and Company Issues can be avoided with proper preparation of the seller and the company. A seller who has reasonable valuation expectations, clean financial statements with verifiable earnings and realistic financial projections help keep most deals out of the ditch.

Posted by Jim Zipursky.