There are many methods of calculating the value of the business; however, many in the mergers and acquisitions field believe that the discounted cash flow (“DCF”) method is commonly considered the best, recognizing the problems of dealing with the future. As the prominent physicist Niels Bohr said, “Prediction is very difficult, especially about the future”.

This methodology looks at the free cash flow (“FCF”), which is the operating profit of the company with non-cash costs, i.e. depreciation and amortization added back for the business for each year into the future. The FCF is critical as that is the cash that is available to the providers of capital to the company – both debt and equity. A business’ value is calculated by estimating the future FCFs and discounting them back by the company’s weighted average cost of capital (“WACC”) as shown below:

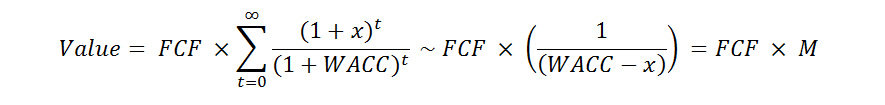

If it is assumed that the FCF grows each year by x% the above equation can be rewritten as:

Where M, the valuation multiple, can be approximated as the WACC divided by the growth rate x. The table below shows the different values of M for different growth rates (x) and WACCs. Remember this assumes the values infinitely into the future and as such company’s growth tend towards the industry norm over time, so sustained high growth rates of are not feasible.

We can assume different multiples for different sized companies based on expected growth and discount rates. Smaller companies often have larger growth rates, but due to the risk associated with them much higher WACCs. Larger companies may have lower growth rates but lower risk and so a lower WACC.

The assumption is often made that Earnings Before Interest and Taxes (“EBIT”) is a good proxy for operating cash flow, and thus Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) is a good proxy for FCF.

This may be true in most cases; however, when looking at a company, do not blindly assume that EBITDA is a good proxy. There are two areas which need examining:

1. Capital Expenditure

Look at how much capital investment (“CapEx”) is as a percentage of EBITDA over the last three or five years. One company that I have recently been involved has a CapEx level to 30% of its EBITDA every year. Thus when looking at their EBITDA on which to apply a multiple, it must be reduced by a thirty percent.

In addition, when looking at CapEx and it is very low over the last few years, but the company has a large amount of capital equipment, it is worth examining if the company has held back on CapEx in order to over inflate its free cash flow. In such cases an adjustment will have to be made to the EBITDA for a normalized amount of capital expenditure and a reduction in the purchase price equal to the declining value of the capital stock that has suffered from lack of CapEx.

2. Working Capital

Working capital is not usually considered in doing EBITDA valuations and applying a multiple. However, if for example a company has an average of 60 days accounts receivable, 45 days inventory and 30 days accounts payable, it has 75 days of net working capital or 20.6% of sales that it has to finance. While this doesn’t matter in most cases other than finding funding for working capital, if the company is growing exceedingly fast, i.e. in excess of 30% a year, this could be a major factor as significant amounts of working capital will be require funding and this will reduce the FCF to the sources of capital. While it is true that at some point in the future, growth will slow, these funding requirements will stop and eventually, these funds returned to the capital providers, the reduction in the FCF in the early years of the acquisition will reduce the value due to the time of money.

Thus, if Company X has an EBITDA margin of 25%, a CapEx requirement of 15% of revenue, a working capital requirement of 20% of revenue and is growing at 30% p.a., the FCF is approximately 4% of revenue – much lower than initially estimated. So when looking at value, don’t just take the EBITDA and blindly assume that it will work. Look behind the numbers to see what, if any, adjustments must be made to get a true proxy of free cash flow.

Posted by Marc Borrelli.